Some Ideas on Home Equity Loan Vancouver You Should Know

Table of ContentsThe Definitive Guide to Home Equity Loans BcWhat Does Home Equity Loans Vancouver Do?The Best Guide To Second Mortgage VancouverThe smart Trick of Mortgages Vancouver That Nobody is Talking AboutNot known Facts About Loans VancouverRumored Buzz on Mortgages Vancouver

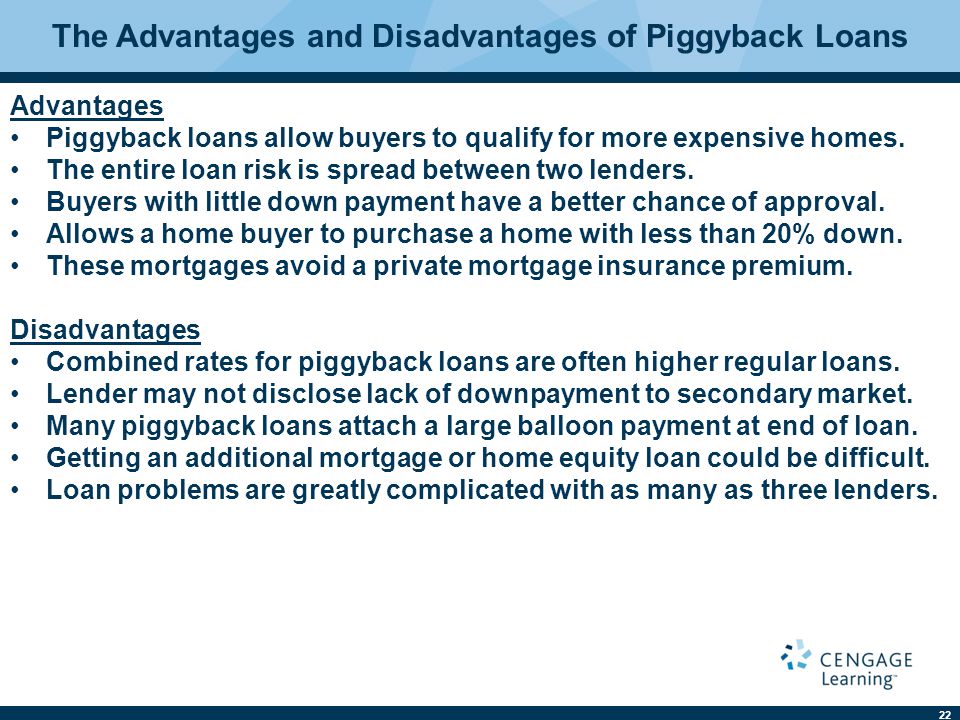

Still have questions? Right here are some other concerns we have actually answered:.In a residence equity funding, you can borrow a round figure of money that you generally pay back in fixed installations over a term of five to thirty years. Just how a lot you can borrow will depend upon just how much of your house you possess outright. Advantages and disadvantages of a residence equity car loan Right here are some pros and also disadvantages to think about before you start filling in car loan documentation.

It will not boost, even when the Federal Reserve elevates rate of interest. Making use of realty as security usually garners lower interest rates compared to other kinds of loans. Given that you're obtaining one round figure as well as have a set rate of interest, your payments are foreseeable as well as won't vary over the life of the financing.

Things about Loans Vancouver

If you pick to use your home equity loan proceeds to enhance your residence, you might have the ability to subtract the interest from your gross income - home equity loans Vancouver. Cons Since a home equity lending's rates of interest won't vary with the marketplace, unlike a home equity credit line (HELOC), the rate for a home equity lending is normally greater.

Similar to a lot of lendings entailing realty, you'll most likely have to pay closing expenses. These expenses can range from 2% to 5% of the lending amount. If you still have a primary mortgage, you now have 2 mortgage settlements, which can decrease your disposable income and make your monthly budget tighter. Loans Vancouver.

Distinctions between HELOCs and also residence equity loans Lots of points are established in rock with a home equity funding, such as your interest rate. In a HELOC, nevertheless, several variables can change over time.

Excitement About Mortgages Vancouver

3 options to a residence equity finance Cash-out refinance A cash-out refinance can be an effective economic device, giving you access to the equity in your home without producing a bank loan settlement. When you re-finance right into a cash-out funding, you obtain even more than you need to mortgage the home as well as pocket the difference in cash.

If you extend your finance term, you might pay extra in interest over the life of the car loan. HELOCs have actually an established draw duration, such as 10 years.

Little Known Facts About Mortgages Vancouver.

Because individual lendings aren't safeguarded they only count on your credit scores their interest prices tend to be higher than finances with collateral, such as a residence or automobile. The ordinary personal car loan rates of interest for debtors with excellent credit rating scores (760-plus) is around 9%, according to about his Borrowing, Tree data.

You've possibly heard of house equity lendings and house equity credit lines (HELOCs) - yet just how beneficial are they when it involves funding restorations? You can utilize a residence equity funding or HELOC for bathroom and kitchen remodels, landscape design, new roof as well as home siding, and much more. Usually homeowners make use of HELOCs to finance major renovation projects, as the rate of interest are lower than they are on individual fundings and bank card.

In this guide, we are mosting likely to have a look at what house equity fundings and also HELOCs are, just how they function for financing remodellings, just how much you can borrow, and the advantages and disadvantages to both of these alternatives. A conventional HELOC could not be the ideal method for you to finance your restoration.

Rumored Buzz on Loans Vancouver

Utilizing Equity To Financing Home Improvements, Using equity to finance a house renovation project can be a smart move. Yet you require to comprehend just how it functions to be able to identify your ideal funding choice. The larger the distinction in between the amount this article you owe on your mortgage and the worth of your residence, the much more equity you have actually obtained.

Your home's value can go down, as well as up. Residential property rates change on a regular basis, and also when the marketplace is executing well as well as rates get on the increase, your equity will boost. However when the marketplace is down, this can decrease the value of your home and decrease Continue your equity.

As an instance, if your residence deserves $500k as well as your current home loan equilibrium is $375k, a house equity loan can let you borrow up to $75k. (90% multiplied by $500k, minus $375k)These are guaranteed loans that utilize your house as security, suggesting that you can lose this in case you are incapable to pay.

Indicators on Home Equity Loan Vancouver You Should Know

They're nearly constantly fixed-rate fundings with established terms, settlements, and also timetables. As soon as you're accepted for a loan, you get the full quantity in one swelling amount.

Tapping all the equity in your home in one swoop can antagonize you if building worths in your location decrease. If real estate worths lower, the market value of your house can decrease, as well as you might wind up owing even more than your home is worth. The residence might be offered to please the continuing to be financial debt if the lending is not paid off or goes into default.